Child Benefit – Everything You Need to Know

There are so many things to think about when becoming a parent and on subsequent additions to the family, that perhaps claiming Child Benefit may be further down the priorities list. I know for me personally, it wasn’t something that I got around to until my daughter was around 8 weeks.

Should I claim Child Benefit?

You can claim Child Benefit if you are responsible for bringing up a child up to the age of 16, or under the age of 20 if they stay in approved education or training.

You can claim Child Benefit 48 hours after you’ve registered the birth of your child, or once a child comes to live with you. Child Benefit can be backdated for up to 3 months.

In 2023/24 the amount you receive is currently £24 per week for the eldest or only child, and £15.90 per week for each additional child.

Essentially, it is something that you should consider within the first 3 months of your child being born, or coming to live with you.

What is the Child Benefit High Income Tax Charge and how does this impact me?

You may be affected by the tax charge if you or your partner’s ‘adjusted net income’ is over £50,000. If you both earn £49,999 then you will not be impacted by this however, if one of you earns over £50,000, the tax charge applies and the highest earner is responsible for paying the tax charge.

There is an online calculator to calculate the amount you may be eligible for and the potential tax charge but essentially this includes all your taxable benefits from your job or self-employment minus any pension contributions deducted from your pay, the net personal pension amount (the amount you actually paid) and gift aid donations. The Cycle to Work Scheme is also an additional allowable deduction.

If you or your partner’s ‘adjusted net income’ is between £50,000 and £60,000 it is still worth claiming Child Benefit and paying the tax charge however, once income exceeds £60,000 the amount you pay in the tax charge is equal to the amount of Child Benefit payable therefore, it doesn’t make sense to opt to receive the Child Benefit however, as I will go on to explain it still makes sense to complete the Child Benefit application form but instead of claiming the benefit select the opt out option on the form.

As an example, your income is £55,000 however, after deducting 5% pension contributions from your salary (£2,750) your net adjusted income is £52,250. In this example for 1 child, you would receive £1,248 pa of Child Benefit and you would pay £187 tax on the Child Benefit you receive, therefore you would still be better off claiming Child Benefit and paying the tax charge.

| Salary | £55,000 | Salary | £55,000 | |

| Pension Contribution (5%) | £2,750 | Pension Contribution (5%) | £2,750 | |

| Net Adjusted Income | £52,250 | Personal Contribution (net)* | £2,250 | |

| Net Adjusted Income | £50,000 | |||

| Child Benefit | £1,248 | Child Benefit | £1,248 | |

| Tax Payable | £187 | Tax Payable | £0 |

*In addition to your net contribution you will receive tax relief of £562.50 directly to your pension.

However, in addition to your standard pension contribution, if you had the capital to make a personal pension contribution of £2,250 (net) grossed up in the pension to £2,812.50 with tax relief this would take your net income to £50,000 or alternatively you could increase the amount you pay into your employers pension so that you pay 10% of your salary £5,500 instead of 5% £2,750.

A benefit of doing so is that you pay more into your pension towards your retirement and as a result you do not pay tax on the Child Benefit you receive.

Should I still make a claim for Child Benefit if I have to pay the Child Benefit High Income Tax Charge?

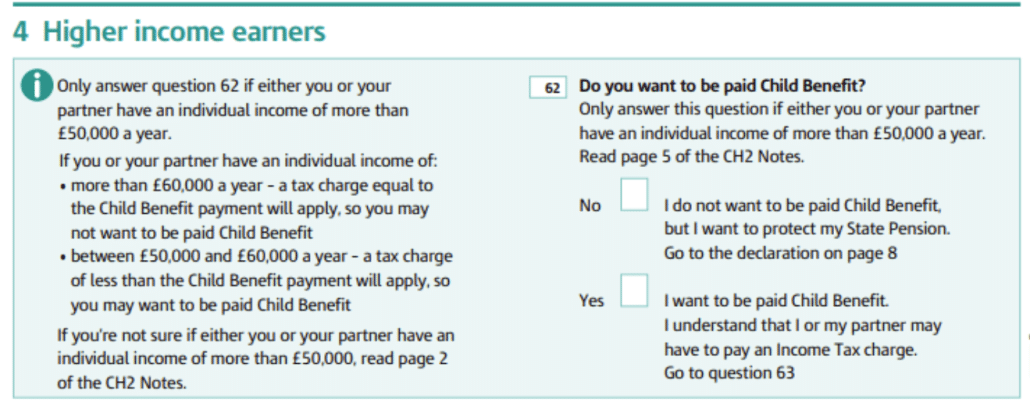

If your income exceeds £60,000 it is still important to make a claim for Child Benefit, however, you have the option of registering for Child Benefit but opting not to receive it. You can do this by selecting No on page 7 of the application form, a picture of which is show below:

I would recommend that everyone applies for Child Benefit even if they decide to opt out of receiving it for the following reasons:

- If you claim Child Benefit, you’ll get National Insurance Credits automatically until your child turns 12. This is particularly important where one parent’s income exceeds £60,000 however the other parent is either not earning enough to pay National Insurance or is not working as they are caring for their child. National Insurance Credits count towards your State Pension entitlement. It is simpler for the lower earner to apply for Child Benefit in their name however, if the higher earner makes the application there is an option to transfer the credits to your spouse or partner who is living with you.

- A National Insurance Number will be generated for your child when they turn 16 years old, without them having to apply for one.

If in future your circumstances change and you wish to start claiming Child Benefit, it makes it much easier having your details in the system that you can report a change in circumstances and opt to receive the benefit and for the reason highlighted above.

In summary:

- You should make a claim for Child Benefit within the first 3 months of your child being born, or coming to live with you.

- If you or your partners’ ‘net adjusted income’ is between £50,000 and £60,000 it still makes sense to opt to receive Child Benefit.

- If you or your partners’ ‘net adjusted income’ exceeds £60,000 then there is no benefit of opting to receive the benefit as the tax you pay is equal to the benefit received however, you should still complete the Child Benefit application form and opt out of receiving the benefit.

Full details on Child Benefit can be found on the Government website here.

Leanne has worked in the financial services industry for over 18 years with experience in both banking and financial services. She is experienced and qualified in all areas of financial planning and specialises in retirement planning. She is qualified as a level 6 ‘chartered financial planner’ and also holds fellowship status which is the highest accreditation that can be received from the Chartered Insurance Institute. Leanne believes financial planning can appear complex however, makes it a priority to remove financial jargon and explains things in a way you can understand.

Leanne is a member of Consensus Collaboration Scotland and has qualified as a Financial Specialist, which enables her to work in collaborative practice with other professionals such as lawyers and family consultants to help clients navigate through Divorce.