Get a consultation

Who are we?

It’s all in the name, at Crystal Clear Financial Planning we promise to understand the things that matter most to you. We offer transparent, personalised, and insightful advice that meets your specific needs.

Crystal Clear Financial Planning was set up in 2011. With many Large Corporate financial Companies pulling out of financial services we decided the time was right to set up a company built around the core values of principles and trust, where we could deliver customers an individually tailored service to the highest standards.

We understand our commitment to do our best for our customers. Whether that be providing mortgage advice, giving advice on various insurance types or offering insight into wills. Our goal is to always support and do our best for you and your family. We know that by working together, the decisions you make today will define and guide your lives for tomorrow.

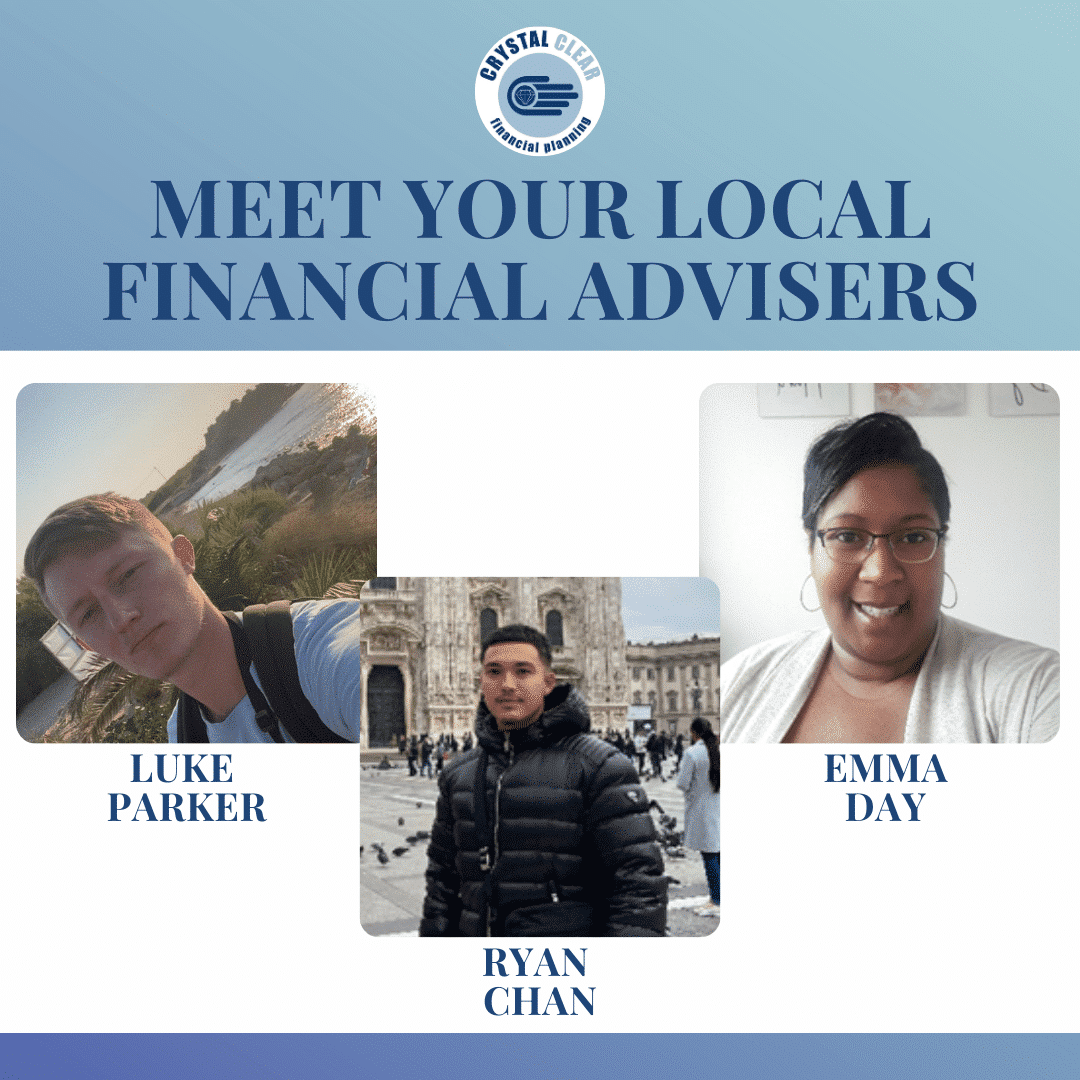

Our friendly team can cover the whole of the UK, providing our specialist knowledge and a guiding hand on the decisions that matter the most to you. With advisers based in Derbyshire, Nottinghamshire, Leicestershire, Birmingham, & Surrey. Our team is constantly growing to make sure we can be the guiding hand through all your financial needs!🤝🏼

What financial planning services do we offer?

Our areas of expertise include-

🏡Mortgages

There is no need to traipse up and down the high street or spend hours on the internet looking for the right mortgage deal for you. Our mortgage service is designed to help save you time and money.

We know how stressful and confusing mortgages can be and that’s where we come in! As your local mortgage broker, we will do all the legwork for you by searching through hundreds of deals from a wide range of different lenders. We are not tied to any one lender, which means we can search the market and find a competitive mortgage for your needs. Whether that be a fixed rate, tracker, variable deals, we will help find you the right option and best rate that suits your financial circumstances.

We are here to guide and support you through every milestone, whether that be buying your first home, moving house, remortgaging or buying to let!

Your home may be repossessed if you do not keep up repayments on your mortgage

💼Protection & Insurance

We know insurance isn’t an easy subject to think about. After all, life is for living, not for worrying about what is around the corner. With our expertise in insurance and protection fields, we can help you find the best option for your needs without the confusion and hassle of doing it all on your own.

We are protection specialists, our job is to do the worrying for you and make sure that you’ve got the right cover in place. To give you peace of mind that you, your family and your home are protected against whatever happens in the future.

Working with the largest protection providers in the industry, our expert team will help you make those all-important decisions. We can search to find you the best policy that fits your needs and requirements, whether that be family protection, critical illness cover, income protection, life cover, home insurance, business insurance or landlord insurance. We will put a plan in place for you to ensure you have that important safety net, you can relax and put those fears to bed!

As with all insurance policies, conditions and exclusions will apply

🏡Equity Release*

If you’re looking to release equity from your home to raise money for your retirement, then we have the perfect specialists for you. Partnering with a national multi-award-winning equity release specialist Viva Retirement, we can look at your individual circumstances to see whether equity release is right for you and your needs. This service is about giving you complete peace of mind in your retirement.

An often complicated and misunderstood area of finance, Viva Retirement offer their expert guiding hand to complete the equity release process quickly, efficiently, and painlessly. Instead of stressing over the paperwork yourself, entrust it to our financial experts and we will take care of all the work for you.

A lifetime mortgage is a long-term commitment which could accumulate interest and is secured against your home. Equity release is not right for everyone and may reduce the value of your estate*

💸Pensions & Investments*

Chrysalis Wealth Management, our sister company; Same office and the same great support staff…

Specialising in Pensions, Savings and Investments. They can provide expert advice on a wide range of financial areas to put together a plan that is tailored to your individual needs and goals, giving you peace of mind about your financial future.

They are here for you; the customer and will always have your best interest at heart. Chrysalis Wealth will help you manage your money, no matter how big or small & Plan ahead for retirement, so when the time comes you can enjoy it!

The value of investments and income from them may go down. You may not get back the original amount invested. A Pension is a long-term investment the fund value may fluctuate and can go down. Your eventual income may depend upon the size of the fund at retirement, future interest rates and tax legislation*

📜Wills & Estate Planning*

Partnering with The Secure Will Company, we can help you understand the many benefits that can be achieved by planning ahead. Many people put off getting a will, dismissing it as something to do later in life. But it’s better to plan for all the possibilities and start now to protect your loved ones. We will provide the helping hand needed to make those tough decisions and provide that much-needed peace of mind

Whether you need advice on your will or require a full estate planning service, Secure Wills can provide everything you need to make the process easier. Their goal is to listen and work with you to reach a solution that suits your specific needs—no generic options. With a personalised approach to wills and estate planning, ensuring you have access to the support needed to make even the most difficult decisions. This is a sensitive topic for many people. We understand how it can feel to have to start this process, so our team of advisors are trained to handle the matter with care and make sure you are listened to.

Wills are not Regulated by the Financial Conduct Authority. Crystal Clear Financial Planning Limited are not acting as appointed representatives of Stonebridge Mortgage Solutions Ltd for Will Writing

🔎Conveyancing*

Alongside our mortgage advice and guidance services, we also offer professional conveyancing to our customers with the help of Sort Refer. Thanks to Sort Refer’s expertise and wealth of experience, they can make the conveyancing process convenient and practical, helping you with your specific needs and timeline.

If you require a friendly, experienced and customer-focused conveyancing service, then Sort Refer are your best bet. They make the conveyancing process smooth, easy and practical to ensure your property purchase is fast and functional. They will take care of all the paperwork and liaising so you don’t have to worry about the technicalities. This means you can focus solely on the beautiful new house that you’ll soon be enjoying and making a home!

Get in touch today and speak to one of our family-friendly advisers, let us help you plan today and protect your tomorrow!

Not too sure where to start? Then why don’t you give us a call for a free consultation to establish your requirements and see how we can help be the guiding hand through all your financial needs, for not only you but your family too!

📞01332 382917 📧[email protected]

The not-so-small print

Crystal Clear Financial Planning Limited is an Appointed Representative of Stonebridge Mortgage Solutions Ltd, which is authorised and regulated by the Financial Conduct Authority. The initial consultation to establish your requirements is free. For mortgage advice, we charge an upfront fee of £199. A further fee may be payable – up to a total maximum of £498 – depending on your circumstances. Services marked with an * are arranged by referral, introduction only.

Get a consultation

- Insurance & protection

- Pensions & retirement

- Mortgages

- Financial planning

- Investments

- Savings

- Business

The mortgage service includes:

• Initial financial consultation

• Affordability and credit research

• Pre-approval via a credit check with the chosen mortgage provider

• Whole of Market mortgage recommendation and explanation of the benefits

• Providing quotations for conveyancing services

• Submission of the full mortgage application

• Ongoing support throughout the process including liaising with the estate agent and solicitor

• Holistic review of all financial commitments

• Holistic review and recommendation of all insurance policies to ensure they meet your new financial obligations

• Sharing the excitement of completing on your new mortgage!!

This is a just a very small way of saying thank you, the job that the NHS staff do is beyond amazing and the staff are worth more than I could ever give back to them.

Usually for mortgage advice, I charge an upfront fee of £299 for our mortgage advice. A further fee may be payable up to a total maximum of £498 – depending on your circumstances. For NHS staff, it will be a flat fee of £199 upon proof of occupation. Your home may be repossessed if you do not keep up repayments on your mortgage.